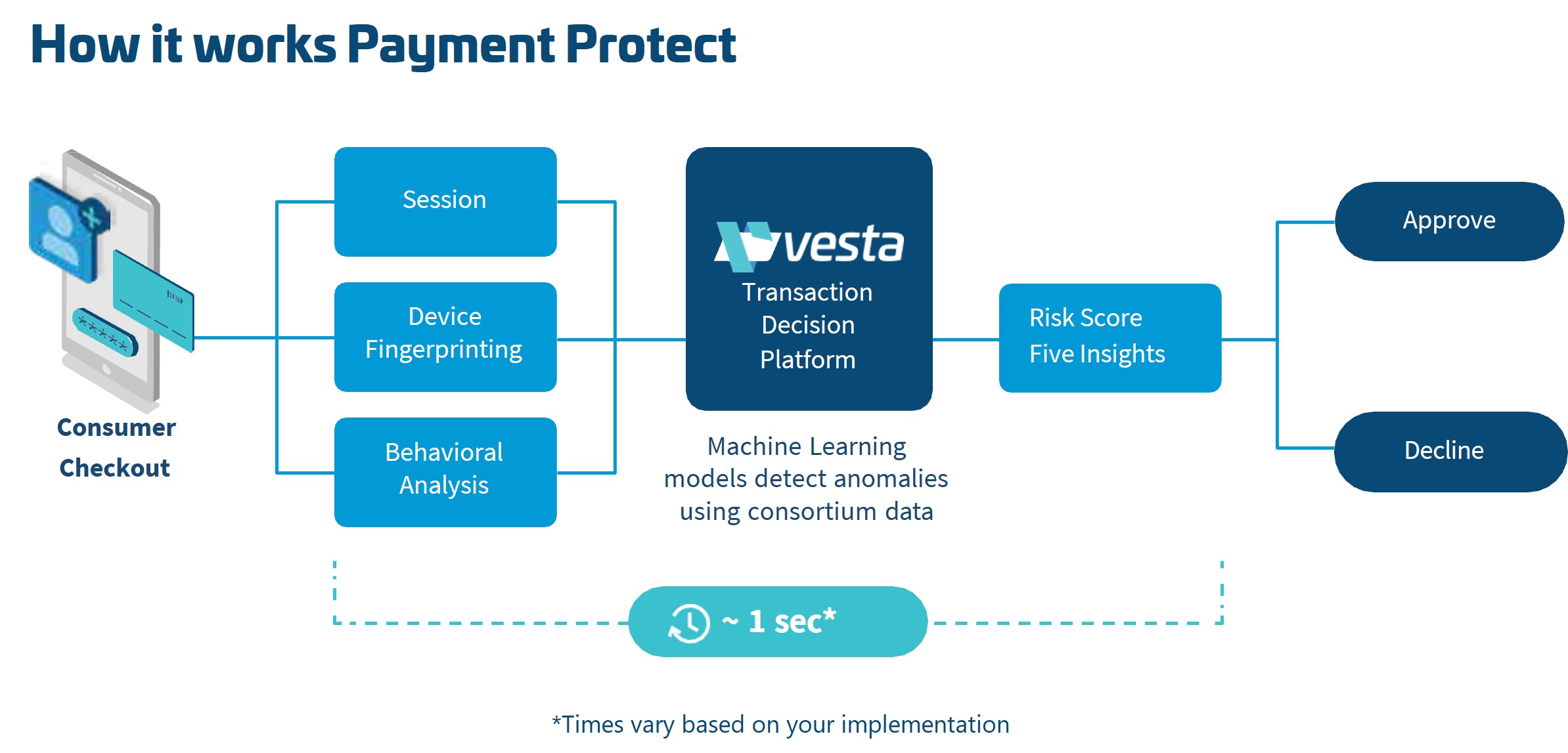

How It Works

Payment Protect combines device fingerprinting and behavioral analytics with our machine learning engine, a database of trillions of transaction data points, and more to identify fraud.

- Behavioral Analytics - Behavioral analytics assigns a unique identifier to your customers, which follows them as they shop and check out. This makes it possible to compare each customer’s behavior to behaviors associated with fraudulent activity.

- Device Fingerprinting - Device fingerprinting powered by ThreatMetrix® identifies unique properties of your customer’s device, including location and type, which are often masked during fraud.

Payment Protect begins working as soon as a customer lands on your website. At checkout, Payment Protect returns information about the transaction that makes it easy for you to decide whether to submit the transaction for settlement:

- Risk Score - The Risk Score is a number from 1 to 100. A higher risk score indicates that the transaction is more likely to be fraudulent.

- Five Insights - The Five Insights give you additional information about the risks that Vesta identified.

Technology

Payment Protect is built on state-of-the-art technologies that provide powerful analytic capabilities and that make it easy to integrate into your website or app.

Data Analysis

Vesta uses machine learning, behavioral models, and deep link analysis to analyze data:

- Machine Learning Platform and Models - Vesta uses machine learning and big data to build baseline models that describe behaviors associated with account takeover fraud. Detecting these behaviors during a transaction is an indication of fraud. Vesta’s models can be updated and deployed within hours, making sure that the protection you get from Payment Protect keeps up with new fraud techniques.

- Patented Deep Link Analysis - By sourcing, cross-referencing, and identifying patterns in data from multiple big-data repositories, Vesta can identify anomalous activity which could indicate fraud.

Data Sources

Vesta uses information from the following sources to detect fraud:

- Customer Behavior - Vesta tracks elements of customer behavior, including the pages your customers visit, how long they spend on each page, and how they select products to identify potentially fraudulent purchases.

- Device Specifics - Vesta identifies unique properties of each customer’s device, including the associated email address, age, and location, by leveraging integrations with vendors including ThreatMetrix® and Ekata. This makes it possible to detect if a customer is masking identifying information as a way to commit fraud.

- Data Vault/Consortium - Vesta participates in the GDPR-compliant consortium data vault, which includes more than 2 trillion data points gathered over 25 years of transaction processing. Vesta leverages this data to identify whether current behavior aligns with previous known behavior.

Integration

Payment Protect provides JavaScript and REST API operations that you will use to integrate its features with your online store:

- REST API - Use REST API requests to obtain a risk assessment from Vesta by sending customer and transaction information to the appropriate endpoint. Results are typically returned in one second or less, excluding 3rd party calls.

- JavaScript - Add JavaScript, provided by Vesta, to each page of your website. The scripts enable Vesta to track unique properties of your customer’s device, which enable us to identify anomalous behavior associated with fraud.

The Integration page describes how to develop and use the basic services included with Payment Guarantee.

Use Case

The steps below describe how Payment Protect integrates with your existing eCommerce experience:

- Customers land on your website. Vesta assigns each customer a unique session ID.

- The session IDs follow your customers as they move from page to page.

- When a customer chooses to check out, you request a risk assessment before or after you submit the transaction for authorization.

The image below illustrates the Payment Protect integration: