Guaranteed ACH

Vesta’s guaranteed ACH feature adds fraud protection to ACH payments that are processed using our Plaid integration. For approved ACH transactions, Vesta covers the amount of the purchase and any returned check fees for checks that are returned for any reason.

Accepting eCheck payments can reduce costs associated with transaction processing fees, but they present unique risks related to fraud, funding, operations, and customer experience. Verifying a customer’s identity and account number is more difficult with eChecks. There is no way to instantly check a customer’s account balance, and it is expensive and burdensome to respond to unfunded transactions due to insufficient funds (NSF). There is a several-day delay between accepting the payment and receiving the funds, which can impact order fulfillment when fraud is a concern. Customers also must enter extra information for authentication and payment, which can lead to friction in your user experience.

Combining Vesta’s fraud protection services with Plaid’s ACH support makes accepting ACH payments on your site a safe and affordable option.

Vesta’s guaranteed ACH feature provides the following benefits:

- Zero Fraud. Zero NSF - Vesta’s Payment Guarantee applies to ACH payments, and we cover the fees associated with transactions that are returned if the account has insufficient funds to cover the transaction.

- Increased Revenue. Decreased Costs - Our fraud protection makes it easy to accept more transactions and completely eliminates costs associated with fraud.

- Operational Enhancements - Guaranteed ACH adds information about the ACH transactions that you process, including risk analysis.

- Improved Customer Experience - Combining Vesta’s fraud protection and Plaid’s ACH service minimizes the details that your customer must submit to pay using ACH.

The sections below define the requirements of our ACH feature, instructions for setting up and using guaranteed ACH, and information about filing claims for returned ACH payments.

Requirements

Our guaranteed ACH feature requires an account with Plaid, and you must set up Plaid Link prior to using guaranteed ACH. Details about setting up Plaid Link are available in the Plaid documentation.

You must integrate our fraud protection services directly into your storefront. The guaranteed ACH feature does not work with our eCommerce extensions at this time. The Setup section below describes how to incorporate guaranteed ACH into your storefront after adding our Behavioral Analytics and Device Fingerprinting scripts.

Guaranteed ACH requires a subscription to Vesta’s Payment Guarantee service.

Setup

Before setting up guaranteed ACH, you must integrate Vesta’s fraud protection services with your account. See the Payment Guarantee onboarding guide for details about adding the Behavioral Analytics and Device Fingerprinting scripts to your storefront.

Next you must set up Plaid Link and obtain a processor token from Plaid, which Vesta will use to submit transactions to Plaid on your behalf. The steps below provide a high-level overview of the Plaid integration process; however, it is important that you review Plaid’s documentation for the most up to date information:

-

Ask your Plaid Account Executive or Growth Manager to enable the Vesta integration on your Plaid account. Create a Plaid account on Plaid’s sign up page, if you have not already.

- Retrieve the following Plaid authentication credentials from the Plaid dashboard:

- Client ID - Private identifier that is required for accessing any financial data.

- Secret - Private identifier that is required for accessing any financial data and is unique to each API environment.

-

Embed Plaid Link in your storefront by adding Plaid’s client-side Javascript. See the Plaid client-side handler instructions for details.

Note: In order to use Plaid Link with Vesta, set the product to

"auth"in the scripts provided by Plaid.

Now that you have integrated Vesta’s fraud protection services and Plaid Link with your storefront, you will use the scripts from Plaid to launch Link and obtain tokens during checkout. See the Use section below for details.

Use

Once you have incorporated Plaid Link into your storefront, you will use the Plaid Link API during checkout to launch Link and generate authentication tokens, as described in the steps below. See the Plaid Link documentation for details. Once you have created the Plaid tokens, you will send them to Vesta using Vesta’s REST API to request risk assessment or authorization.

-

At checkout, use the Plaid API to generate a

link_token. See Plaid’s Token endpoints documentation for details. You will need to use theclient_idandsecretthat you obtained during the setup process. -

Call the

Plaid.createJavascript method to launch Link for your customer. You will include thelink_tokenin the method call as shown in Plaid’s Create method definition. Plaid will call theonSuccesscallback function when your customer has successfully onboarded an item. Plaid will pass apublic_tokenandmetadataas arguments to theonSuccessfunction. -

Exchange the

public_tokenfor anaccess_tokenusing Plaid’s token exchange endpoint. -

Use the

access_tokento create a Vestaprocessor_token. See Plaid’s processor token endpoint documentation for details. -

Send the

processor_tokento Vesta in the body of theCheckPaymentFraudRequestorCheckPaymentRequestoperations to request approval or risk assessment for the transaction. See Vesta’s developer documentation for details.Vesta will return a guarantee decision and a risk score, which you can use to decide whether you will accept the transaction and submit it for clearing. Once you have made your decision, send a POST request to Vesta’s

Dispositionendpoint to update Vesta about the final status of the transaction.

Filing an ACH Claim

Vesta makes it easy to file a claim for a returned check using the Partner Portal. Detailed instructions for filling a claim are available in the Partner Portal documentation. The steps below describe the process, and include details specific to filing claims for returned ACH payments:

-

Log in to the Vesta Partner Portal and open the transactions list.

-

Locate the transaction that was returned, and click on the row to display the transaction details.

-

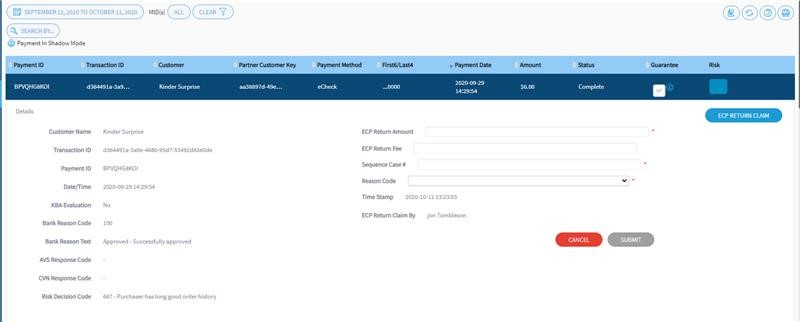

Click the ECP RETURN CLAIM button. The claim form, shown in the image below will open:

-

Fill in the claim form and click the SUBMIT button. The Portal will display the claim details below the transaction details. The ECP Return Claim Status in the right column will be New. The image below shows the details for a claim that was just submitted:

When the ECP Return Claim Status changes to Under Review, a Vesta team member has started reviewing the claim. The status will change to Approved or Declined when the review is complete.